reverse tax calculator uk

The current standard rate of VAT in the UK is 20 for most goods and services. Add or Reverse VAT Calculator.

Sales Tax Calculator Vat 2020 By D App Online Ltd

The net to gross salary calculator requests the net pay required and then computes the gross pay computing.

. Transfer unused allowance to your spouse. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. For example 60 12 UK VAT rate 50 price without VAT Original figure 60 50 price without VAT.

Here is how the total is calculated before sales tax. Take the sum you want to work backwards from divide it by 12 1 VAT Percentage then subtract the divided number from the original number that then equals the VAT. That means if you have a figure inclusive of VAT Value Added Tax and want to do a vat calculation to remove the 20 VAT then use this reverse VAT calculator.

Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. This calculator works on the current United Kingdom VAT rate of 20. VAT stands for value-added tax.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Check your tax code - you may be owed 1000s. UK customer to account for the output tax adjustment of X to HMRC.

UK 2022 2023. Reverse Calculate Income Tax - Calculate Net to Gross - Find out how much you need to earn before tax to take home an income you enter - for PAYE CIS and Self Employed. Subtract the price of.

Any National Insurance costs are taken as a percentage provided that your salary is above 190 each week or 9880 per year from 6 July 2022 to 5 April 2023. UK Tax Salary Calculator Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Up to 2000yr free per child to help with childcare costs.

Calculate your salary take home pay net wage after tax PAYE. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. Using the calculator you can calculate the gross pay before tax for a required level of take home pay.

Now you divide the items post-tax price by the decimal value youve just acquired. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Amount without sales tax GST rate GST amount.

2675 107 25. Cash accounting scheme. Income Tax Calculator is the only UK tax calculator that is EASY to use FREE.

We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15. This alongside other taxes is collected by the government and redistributed in order to fund various public services.

20 VAT UK normal rate 5 VAT UK reduced rate 0 VAT UK zero VAT UK Amount without TVA UK. Amount without sales tax QST rate QST amount. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. This calculation is used on a regular basis by Personal Injury and Family Law lawyers. This calculator is useful if you want to calculate VAT backwards.

When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator. You may reclaim the input tax on your reverse charge purchases subject to the normal VAT rules. Value Added Tax was introduced in 1973 as a replacement for Purchase Tax and Selective Employment Tax as a condition of UK entry into the European Economic Community.

Free calculator of inverted taxes for United Kingdom. Free tax code calculator. Our CIS Tax Deduction Calculator can assist contractors in calculating the correct deductions to make.

To start using The Tax Calculator simply enter your annual salary in the Salary field in the left-hand table above. As of the 4th of January 2011 the default VAT rate stands at 20. Basically it is a tax on business transactions.

Lets calculate this value. This is based on Income Tax National Insurance. Do you like Calcul Conversion.

It is levied on nearly all goods and services provided by UK registered businesses. It will work for all types of subcontractors Gross 0 CIS Deduction Net 20 CIS Deduction and Unregistered 30 CIS Deduction. It includes the net to gross tax calculator.

Divide the price of the item post-tax by the decimal value. VAT - or Value Added Tax - is charged by businesses at the point of sale of goods and services sold in the UK and the Isle of Man. It has also been updated for the VAT reverse charge requirements which apply from 1st March 2021.

242 per week or 12570 per year. This tells you your take-home pay if you do not have. You can use tax rates from 2013 to 2002 and specify either weekly or annual net after Tax earnings.

Amount with VAT UK VAT UK. Reduce tax if you wearwore a uniform. Value Added Tax VAT is a tax thats charged on most goods and services in the UK but only charged by VAT-registered businesses.

Want to know. This VAT calculator selects the 20 rate by default so please select a different rate if you need to. Reverse Tax Calculator - Net To Gross.

National Insurance Contributions will be taken from your overall income though unless you have already reached the state pension age. This will give you the items pre-tax cost. 11 income tax and related need-to-knows.

In short work backwards from the money you want to take home to the Gross salary required to give you that take home pay. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. If you know your tax code you can enter it or else leave it blank.

Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay.

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Calculator Vat 2020 By D App Online Ltd

Sales Tax Calculator Vat 2020 By D App Online Ltd

Ultimate Corporation Tax Calculator 2022

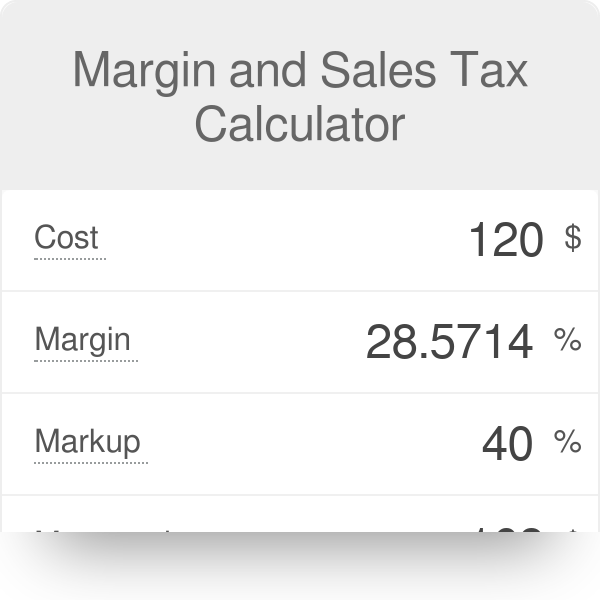

Margin And Sales Tax Calculator

Pin By Marina Seganti On Passiocase Reverse Image Search Online Presence Image Search Engine

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Sales Tax Calculator And De Calculator Sales Tax Calculator Tax

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

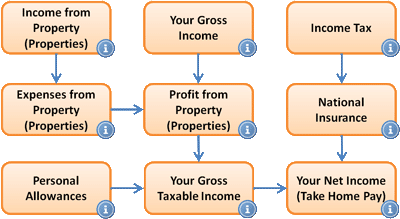

Landlord Income Tax Calculator Icalculator

The Hp 15c Calculator Scientific Calculator Was An Rpn Reverse Polish Notation Calculator That Was Popular Wi Scientific Calculator Old Calculator Calculator

Filing Itr With All India Income Tax Return Income Tax Tax Refund